This past week, the U.S.-China trade fight moved decisively onto the water, Freight Right Global Logistics reports. On Oct. 14, Washington and Beijing both activated reciprocal port-entry fees that target each other’s shipping ecosystems, adding direct costs for carriers (with detailed carve-outs and five-voyage annual caps) and potential pass-through costs for cargo owners. At the same time, product-specific U.S. tariffs (e.g., wood products and furniture) kicked in, and markets braced for Nov. 1 measures, 25% on medium/heavy trucks and an additional 100% tariff on all Chinese imports alongside new export-control moves.

Overlapping this, China’s rare-earth export curbs prompted the EU to coordinate with the US/G7 on critical-mineral resilience. Net-net: Policy risk rose across ocean shipping, manufacturing inputs and downstream consumer goods, with logistics and sourcing teams facing immediate fee exposure at ports and a near-term step-up in tariff and licensing complexity.

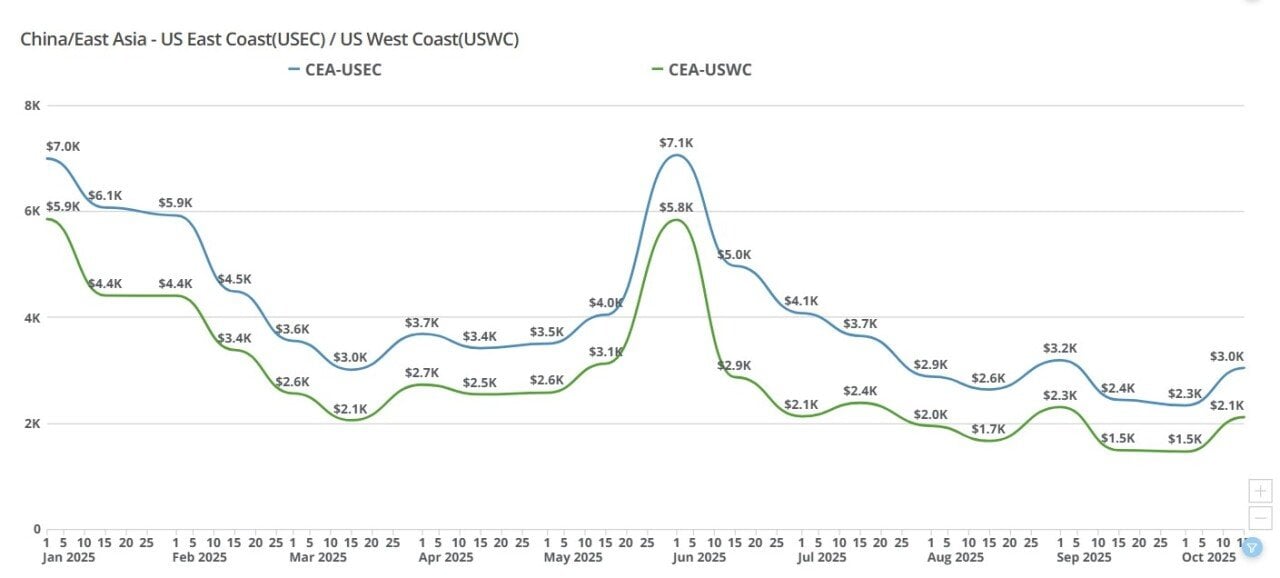

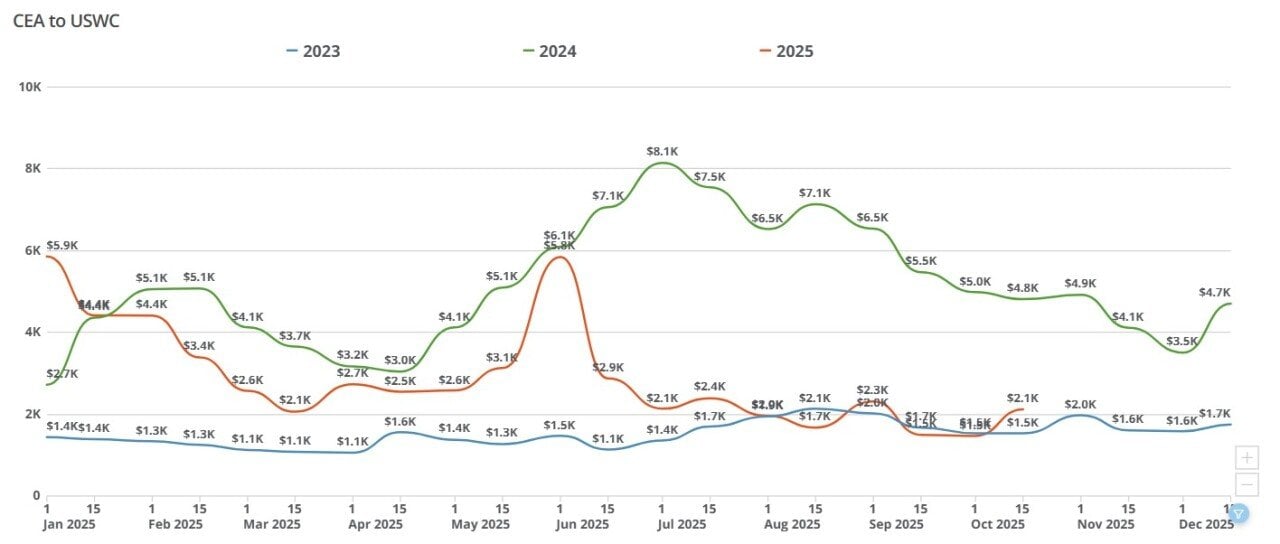

China (CEA) to the United States West Coast (USWC) : FEU spot freight rates climbed roughly $700–$900 w/w to about $2,000–$2,100/FEU on mid-month GRIs and acute space tightening.

China (CEA) to United States East Coast (USEC): FEU spot freight rates rose about $700–$800 w/w to roughly $3,000–$3,100/FEU, but is unlikely to hold given transit times that miss the Nov. 1 tariff risk window.

Week of October 13, 2025:

Pictured: 2023-present FEU rates between China to United States East Coast (USEC) and China to United States West Coast (USWC)

Pictured: 2023-present FEU rates between China to United States East Coast (USEC)

Pictured: 2023-present FEU rates between China to United States West Coast (USWC)

The next two weeks are going to be ones to watch. For USWC, elevated rates are likely to hold through this week as last-minute cargo chases the only lane that can still arrive in time; modest easing is possible next week if bookings pause post-deadline. For USEC, this week’s bump looks fragile; with arrival deadlines missed, expect faster giveback as shippers step back and carriers reassess GRIs/PSS on softer near-term demand.

With capacity trimmed and policy headlines in flux, expect choppy, headline-sensitive pricing into late October, tight in the near term, then cooling if the tariff rush fades.

The timing of this week’s GRI combined with the sudden announcement of 100% tariffs on Chinese imports on top of existing tariffs placed on China is also something to be mindful of. The observation among those in the industry is the speed of the tariff announcement, specifically, will take many importers by surprise as the announcement was made late last week, going into the weekend. Importers will have about two weeks to claim carrier space amidst extensive blank sailing and limited space to secure their shipments so that they arrive in the U.S. by Nov. 1 or be faced with the 100% tariff.

Others in the industry notice that carriers benefit the most from this artificial demand creation, and importers are left shouldering higher costs.

Following the end of the de minimis exemption, China-U.S. air freight volumes remained soft through late September.

Air rates rebounded entering this week, driven by pre-holiday shipments and capacity constraints.

With charter flights resuming this week, the market was expected to normalize-until the Oct. 10 announcement of potential 100% U.S. tariffs reignited demand.

Immediate increases are expected from express channels, traditional B2B exporters, and Apple-related shipments. Current spot levels are averaging $6.0–$6.5/kg and still climbing.

Air freight rates are projected to remain elevated through the end of October, supported by urgent cargo movements ahead of the possible tariff deadline. Market direction for November will hinge on the final tariff decision, with either a brief cooling if rates stabilize or further escalation if new measures take effect.

This story was produced by Freight Right Global Logistics and reviewed and distributed by Stacker.

Reader Comments(0)