The nightmare scenario for any homeowner during the bitter chill of winter isn’t a power outage; it’s coming home to a flood. That sudden, devastating rush of water from a burst pipe, frozen solid by the deep cold, can cause tens of thousands of dollars in damage, instantly soaking walls, flooring, and all your treasured possessions. Naturally, your first thought may be, “Thank goodness for homeowners insurance!”

But here’s a cold truth that catches many off guard: Just because your pipes burst doesn’t mean your insurer will automatically pay up. In fact, a significant number of frozen pipe claims are denied every year, often because the insurance company alleges negligence on the part of the homeowner.

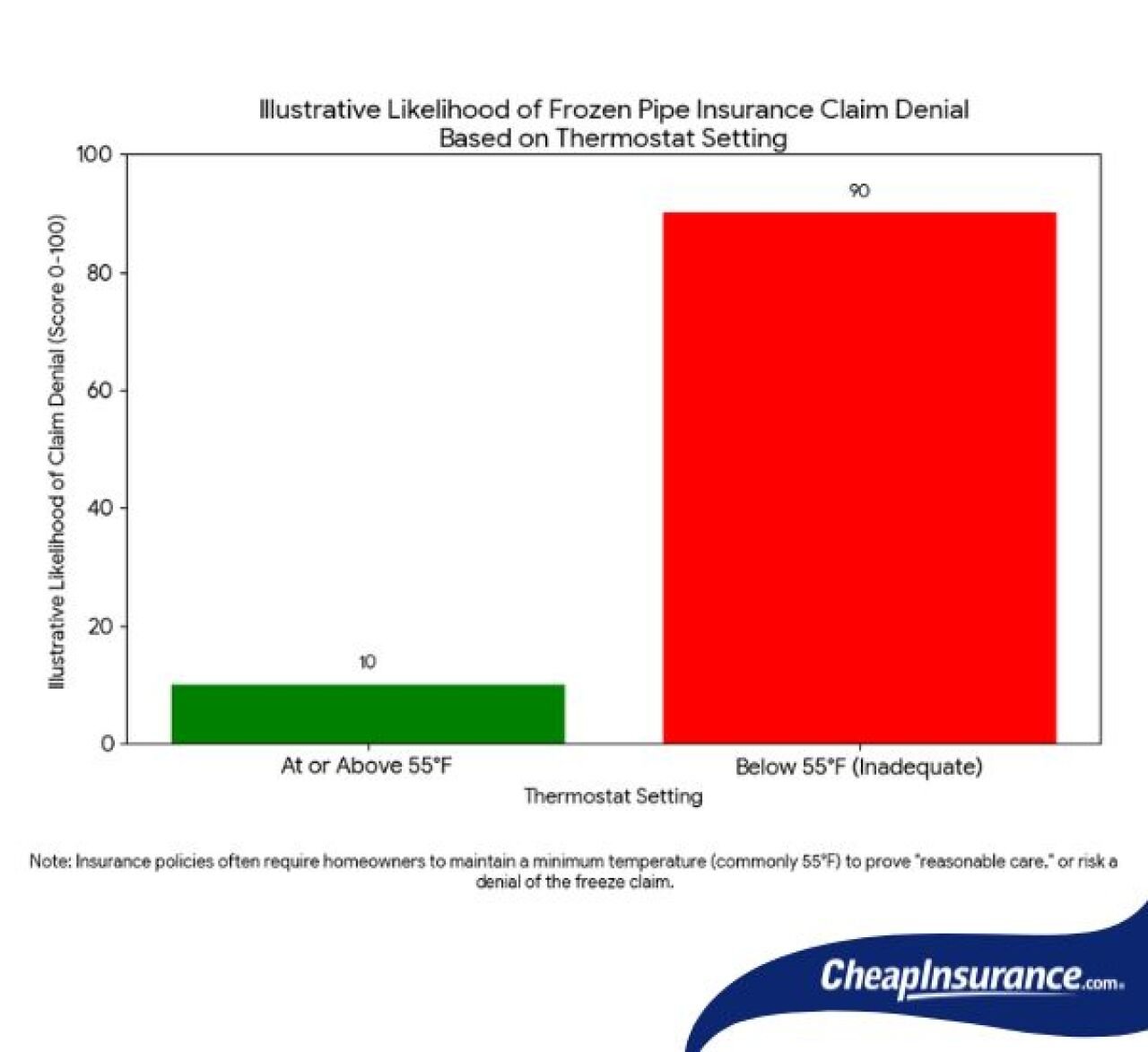

It all comes down to a crucial distinction in your policy, a distinction so fine it can feel like threading a needle: Was the burst pipe a sudden, accidental loss beyond your control, or was it a preventable issue resulting from your failure to take “reasonable care”? CheapInsurance.com explains how to avoid a claim denial by taking simple preventative measures, the most crucial of which involves maintaining adequate indoor temperatures.

Most standard homeowner’s policies (the common HO-3 form) provide coverage for water damage from a burst pipe. Insurers cover what they consider “perils,” unforeseen events like fire, theft, or a sudden plumbing failure. The key words here are sudden and accidental.

If a pipe, properly maintained and insulated, freezes and bursts during an extreme, unprecedented cold snap despite your best efforts to heat the house, that is generally considered a covered event. It’s an accident. It’s a peril.

However, almost every policy contains a critical exclusion related to freezing. This exclusion states that the loss is not covered if it resulted from freezing while the property was vacant, unoccupied, or if you failed to use reasonable care to maintain heat. This is where the battle between heat and negligence begins.

The biggest, reddest flag for any insurance adjuster investigating a frozen pipe claim is a lack of heat. If your home’s pipes froze, the insurer will immediately look for evidence that you neglected to keep the house warm enough.

If you leave for a winter vacation, a common clause in your policy demands that you either:

Failing to do either of these while you’re away can be an open-and-shut case for a claim denial. Think of it from the insurer’s perspective: If you left your house unheated during a subfreezing week, you essentially invited the freezing.

This is where things get tricky because the insurance policy rarely specifies an exact temperature. This ambiguity leads to a lot of legal wrangling, but there are some generally accepted benchmarks:

If the adjuster finds evidence of a minimal energy bill suggesting the heat was turned off, or if the home’s records indicate a temperature well below the 55-degree threshold, they have a strong basis to allege negligence and deny the claim.

Negligence isn’t just about the thermostat setting. It encompasses any failure to take the common-sense, preventative actions that a prudent homeowner would take to protect their property. Insurers look for two other major areas of neglect.

Insurance is for sudden and accidental loss, not for gradual wear and tear. If your pipes were already corroded, old, or improperly insulated, the insurer may argue the freeze was simply the straw that broke the camel’s back — a consequence of poor maintenance, not an accident.

Examples of negligence by neglect:

If a pipe freezes and bursts, your responsibility as a policyholder doesn’t end there. You have a duty to mitigate further damage. If you discover a leak and fail to shut off the main water supply to stop the flood, the insurer can deny coverage for the additional damage that occurred due to your inaction. Delaying the claim filing or clean-up process can also be viewed as a failure to mitigate.

To ensure your claim stands a fighting chance against an allegation of negligence, take these concrete steps every winter.

Don’t guess. Pull out your policy and look for the “Water Damage” or “Freezing” exclusion section. Note any minimum temperature requirements or specific rules for when the property is unoccupied.

Keep the heat set at 55 degrees Fahrenheit (13 degrees Celsius) or higher, especially when away. Better yet, install a smart thermostat or a low-temperature monitoring device that alerts you if the temperature drops too low. This creates an invaluable digital record proving you maintained heat.

If a burst occurs, your priority is stopping the water and mitigating damage. But immediately after, document, document, document:

A frozen pipe disaster is stressful enough without the added fear of a denied claim. By understanding the critical line between a sudden, accidental loss and a failure to exercise reasonable care, you can arm yourself with the knowledge and the preventative measures to keep your home warm and your insurance policy valid. Don’t let your winter claim freeze over.

This story was produced by CheapInsurance.com and reviewed and distributed by Stacker.

Reader Comments(0)