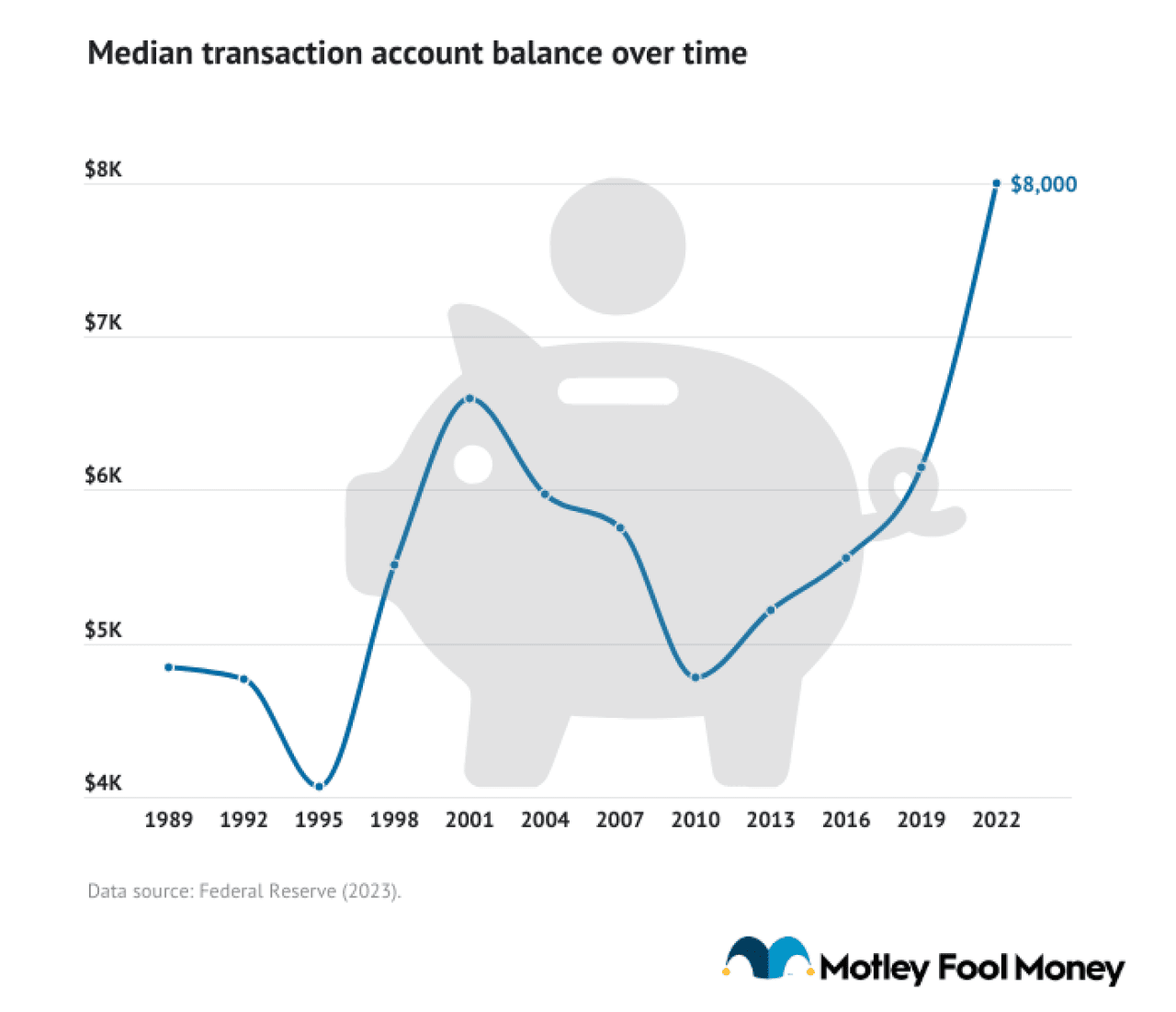

The typical American household has $8,000 in its bank account, according to the latest data from the Federal Reserve’s Survey of Consumer Finances, carried out in 2022. That’s the median transaction account balance as of 2022, which includes savings, checking, money market, call accounts, and prepaid debit cards. The average balance in those bank accounts among American households is $62,410.

Despite the median bank account balance being up nearly $2,000 from 2019, just 40% of Americans surveyed in July 2024 by Motley Fool Money feel financially secure. In line with that finding, the Federal Reserve found that only 57% of Americans have savings that could cover three months of expenses and just 44% could cover a $400 expense with money from their checking or savings account.

The median bank account balance for American households is $8,000, according to the Federal Reserve’s most recent data. That amount is what people hold in transaction accounts, which include checking, savings, money market, call accounts, and prepaid debit cards.

That’s up from 2019, when the median transaction account amount was $6,140 and much higher than the balance recorded in 2010, $4,780.

The average bank balance in 2022 was $62,410, up from $48,220 in 2019 and $44,050 in 2010.

When a median is much lower than a mean, it suggests a larger number of people have less than the mean. To put it simply, the median is more representative than the mean.

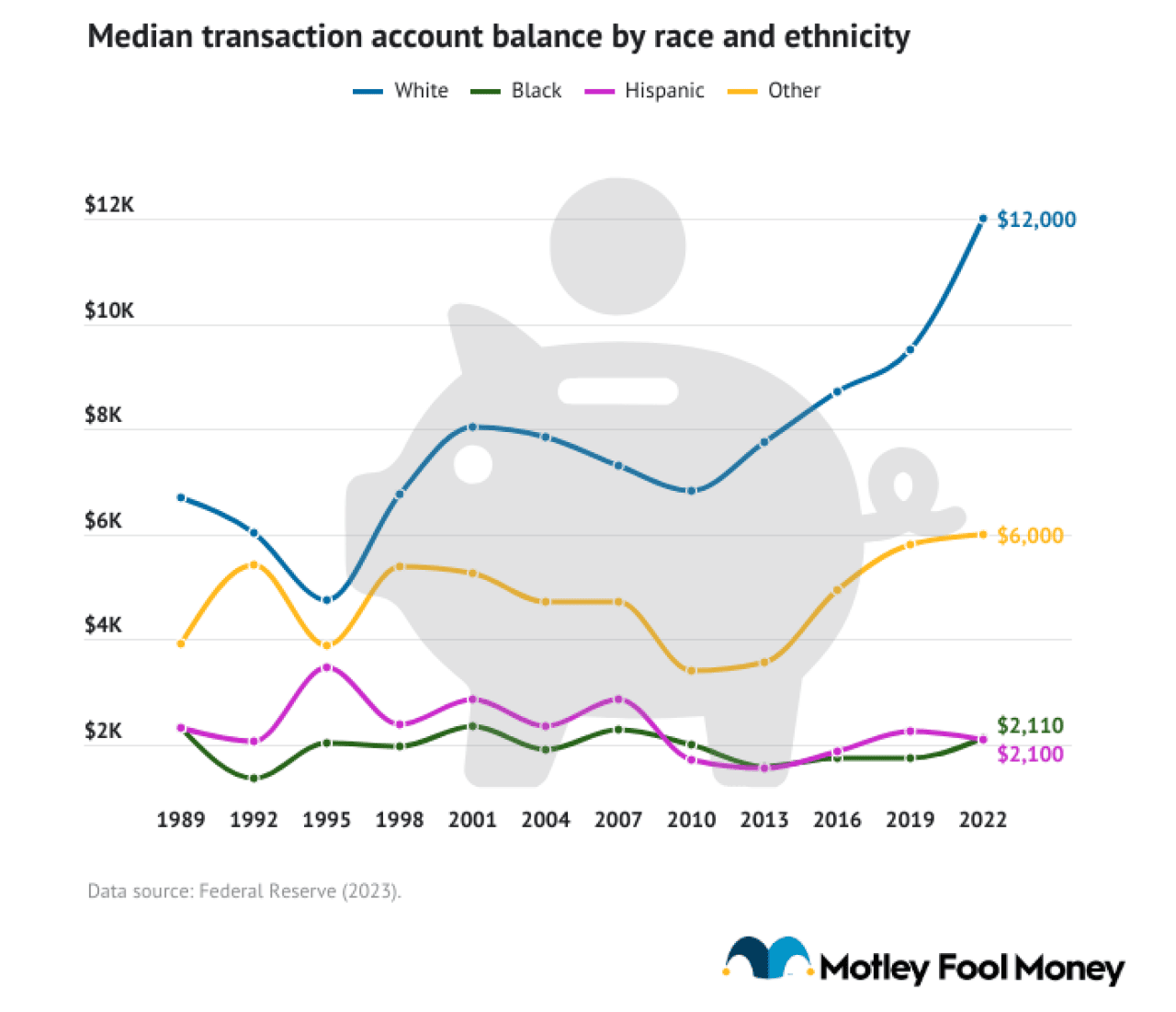

White American households have a median of $12,000 of cash on hand, roughly six times the amount that Black and Hispanic American households hold, according to the Federal Reserve. White households also have twice the median transaction account balance than households in the “other” category, which accounts for mixed race, American Indian, Alaska Native, Native Hawaiian and Pacific Islander households.

The gap in transaction account values between white and Black and Hispanic households is even larger when looking at averages. White American households have an average transaction account balance of $80,000, while Black American households hold $13,370 and Hispanic American families have $15,710 in the bank.

Bank account balances have hardly changed for Black and Hispanic Americans over the past 30 years when looking at both the median and mean transaction account values for those groups. On the other hand, the median balance for white Americans has nearly doubled and the average balance has more than doubled.

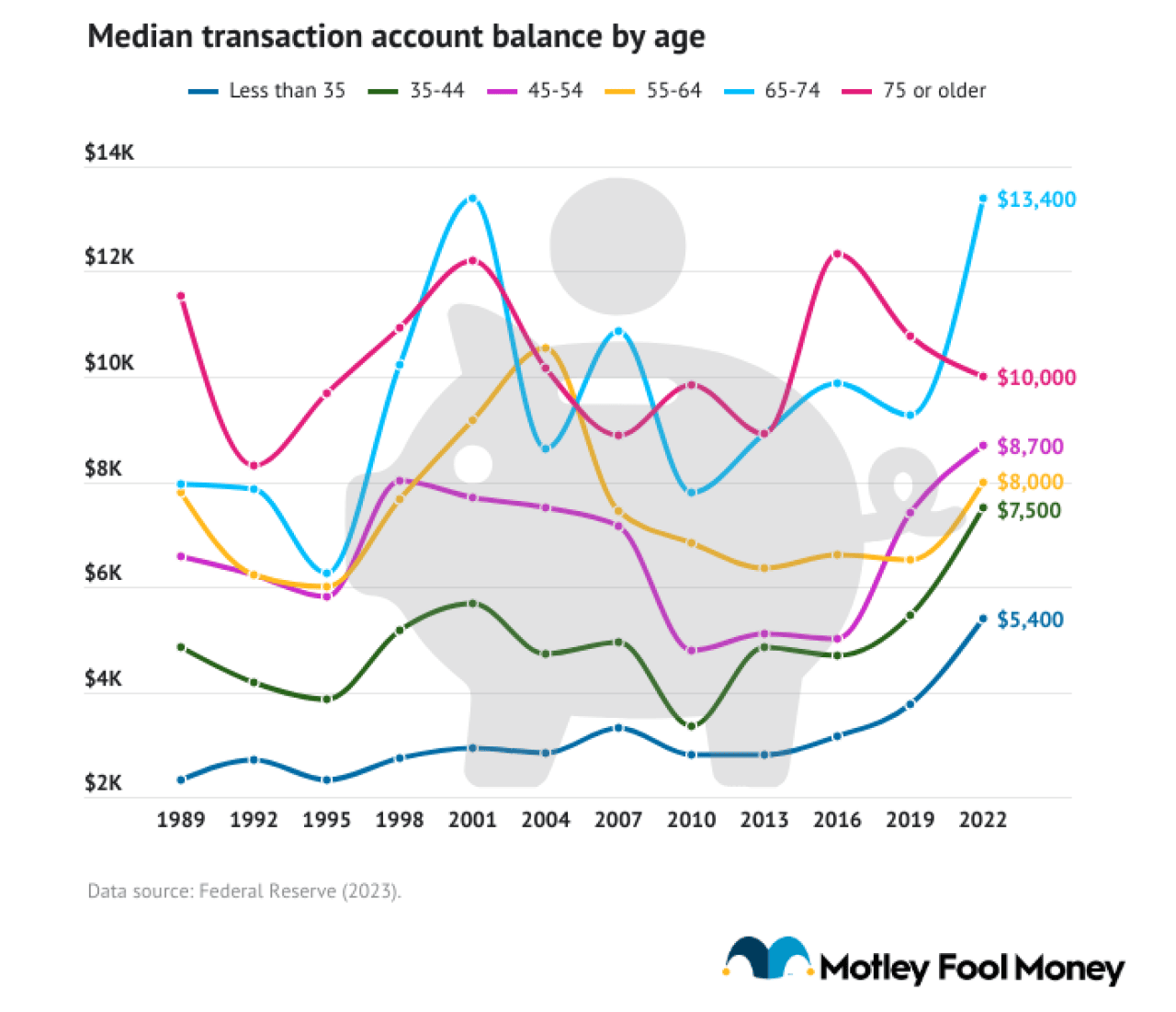

Older Americans tend to have more cash on hand, although the difference among age groups is smaller than expected.

The median balance in all transaction accounts, including savings, for those under 35 is $5,400. That rises to $7,500 for those between 35 and 44, $8,700 for those 45 to 54, $8,000 for those 55 to 64, and $13,400 for those 65 to 74. Median bank account balances drop off to $10,000 for those 75 and older.

The same pattern holds when looking at average transaction account balances by age, although at a wider scale. The average bank account balance for those 65 to 74 years old is $100,000. The average account balance drops to just over $70,000 on average for those aged 45 to 64, and to $21,000 for Americans 35 and younger.

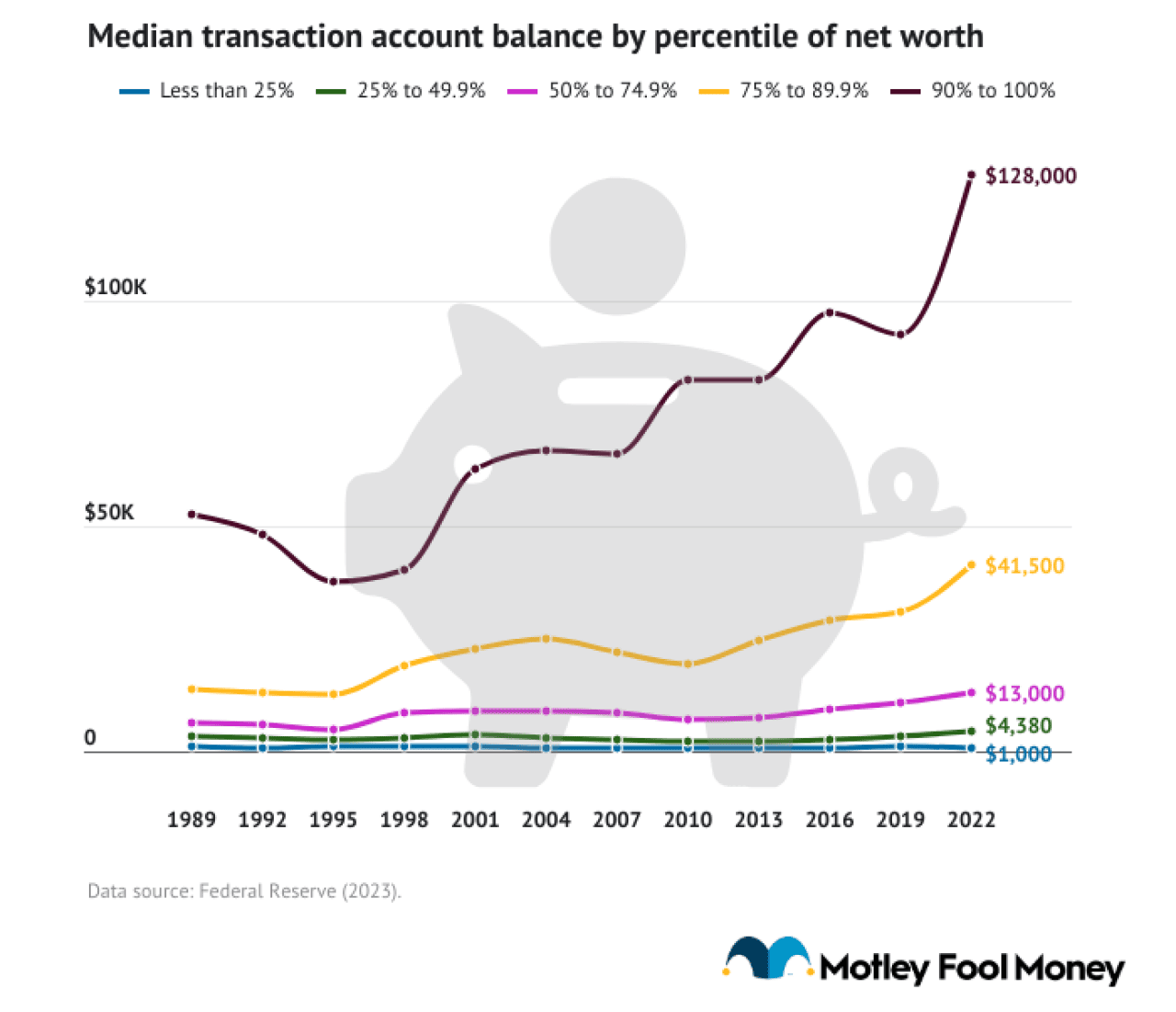

The richest American households — those in the top 10th percentile of net worth — have a median transaction account balance of $128,000. That’s more than five times the median balance held by those in the 75th to 89th percentile of net worth and 128 times the median balance for those in the bottom 25% of net worth.

The difference in household bank account balance by percentile of net worth is even larger when comparing averages. Those in the top 10% of net worth have $379,000 in their transaction accounts, on average, compared to $85,000 for those in the 75th to 90th percentile, and less than $30,000 for less wealthy Americans. Those in the bottom 25% by net worth have an average bank account balance of just $3,500.

Thirty-nine percent of Americans surveyed by Motley Fool Money have a separate emergency savings account.

Younger survey respondents were more likely to report having a separate savings account for emergencies. Forty percent of Gen Z and 47% of millennial respondents have a savings account just for emergencies compared to 32% of Gen X and 38% of baby boomers.

Having two savings accounts can seem like a hassle, but for some it is a useful way to manage finances. Separating savings into different accounts to cover expenses in the event of a job loss and savings for unexpected everyday expenses, like car maintenance or medical bills, can reduce anxiety and make it easier to track financial goals.

An emergency fund calculator can help determine how much you might need to save.

Seventy-five percent of Americans could cover a $400 emergency expense in 2024 — with cash on hand or by using a credit card and paying it off at the next statement. That’s up from 63% in 2023, according to the Federal Reserve.

Out of that group, just 44% could cover a $400 emergency expense without using a credit card, using funds only from their checking or savings account.

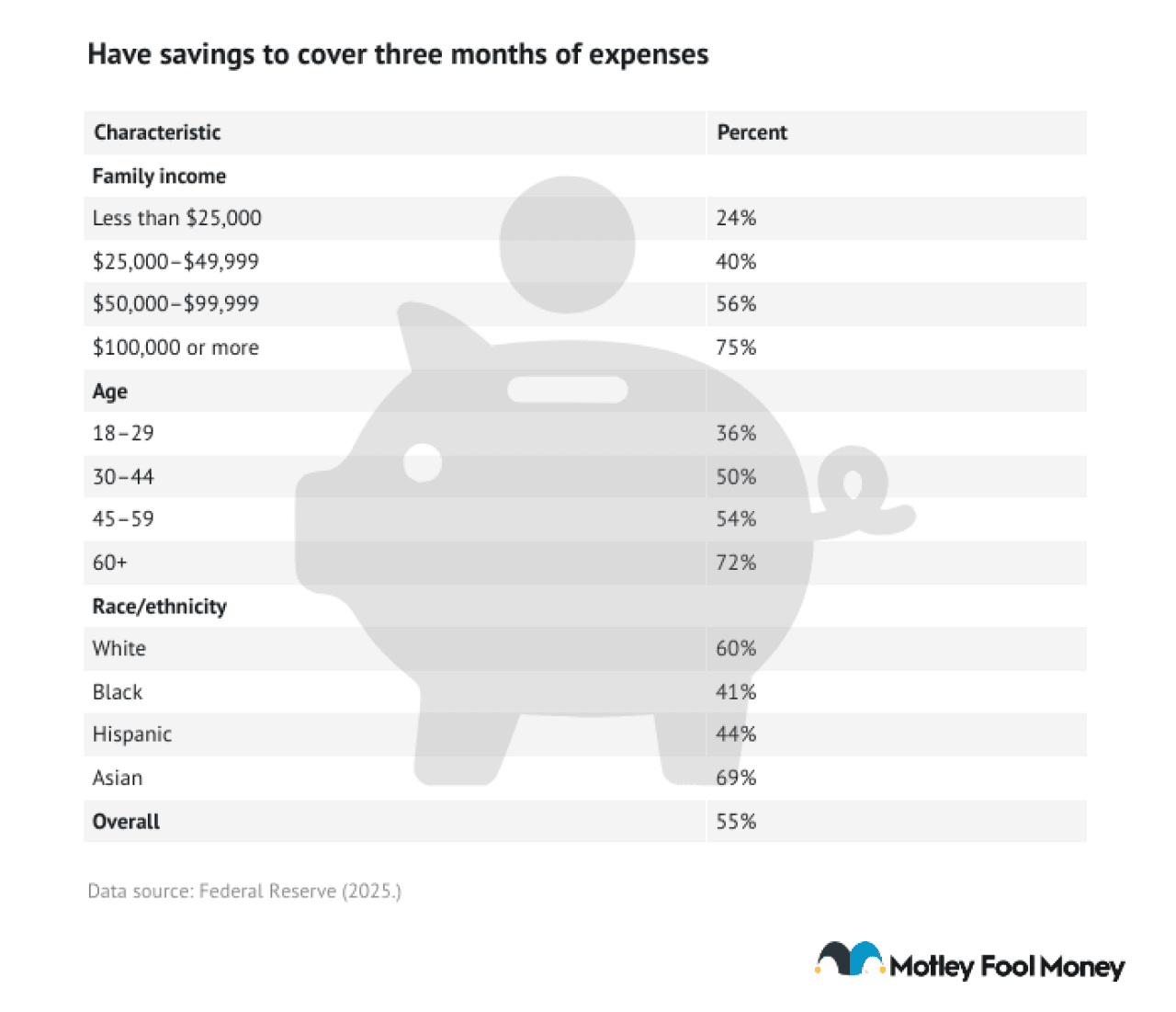

Fifty-five percent of Americans have three months of emergency savings, per data collected by the Federal Reserve.

That’s slightly up from 2023 and down from 59% in 2021. The Federal Reserve did not clarify whether that money is held in a separate “rainy day” account.

Three months’ worth of living expenses is the minimum experts recommend to aim for with an emergency fund.

Many people need six or more months’ worth of living costs in the bank to feel secure, so it’s likely that some people pad their emergency savings for extra peace of mind.

Thirty-four percent of Americans surveyed by Motley Fool Money have a savings account with an interest rate of at least 4%. That’s up from 31% among those surveyed in 2023.

High-yield savings accounts — which offer much higher annual percentage yields (APYs), or interest rates, than the national average — have become more attractive and widespread as the Federal Reserve has hiked the federal funds rate.

It’s important to note that savings account interest rates fluctuate, which is why experts recommend comparing APYs before opening an account.

Older Americans surveyed by Motley Fool Money are less likely to have a savings account with an interest rate of 4% or more. Millennials are most likely to have a savings account with at least 4% APY.

The top reason more Americans don’t have a savings account with an interest rate of 4% or more is that they don’t think they have enough savings for a higher interest rate to make a meaningful difference.

The second most cited reason for not opening a savings account with an interest rate of 4% or more is not knowing accounts with those rates are available. Twenty-two percent of respondents said lack of knowledge was the main reason they didn’t have that type of account, and baby boomers were least likely to know savings accounts with yields over 4% are offered.

Here are the other reasons Americans surveyed who don’t have a savings account with an interest rate of 4% or more haven’t opened one:

Another reason Americans surveyed aren’t likely to have a savings account with an interest rate of 4% or more is that most (59%) value a bank’s reputation more than a high interest rate attached to their savings account.

Older respondents place more value on a bank’s reputation than younger Americans.

Most Americans don’t have enough savings to cover three to six months of expenses, based on data from the Federal Reserve, given that the average household spends $6,081 but the median balance across transaction accounts is $8,000.

It’s no surprise that saving more is a major goal for most Americans. Saving for a major life milestone, like a home, wedding or car, and saving for retirement are two of the top four financial resolutions heading into 2026.

If you feel that your savings could use some work, Motley Fool Money personal finance expert Joel O’Leary recommends a few simple moves to help your bank account grow.

The Motley Fool surveyed 2,000 American adults on July 8, 2024. Results were post-stratified to generate nationally representative data based on age and gender. Pollfish employs organic random device engagement sampling, a method that recruits respondents through a randomized invitation process across various digital platforms. This technique helps to minimize selection bias and ensure a diverse participant pool.

This story was produced by Motley Fool Money and reviewed and distributed by Stacker.

Reader Comments(0)